Personal finance, as a word, encompasses the principles of money management, saving, and investing. As the name suggests – personal finance deals with achieving personal financial objectives, such as saving for short-term financial requirements, planning for retirement, or saving for your child’s college education.

It mostly depends on your income, spending habits, living needs, and individual objectives, as well as the strategy you develop to achieve those goals within your financial limits.

We, at TangoLearn have selected some of the best basic personal finance courses that will provide you both practical & theoretical personal finance training.

Top 11 Personal Finance Certification Courses

- The Complete Personal Finance Course: Save, Protect, Make More (Udemy)

- Personal Finance Masterclass – Easy Guide to Better Finances (Udemy)

- The Core Four of Personal Finance including Recession Basics (Udemy)

- The Fundamentals of Personal Finance Specialization offered by SoFi

- Acorns’ Guide to Personal Finance (Udemy)

- Personal Financial Well Being (Udemy)

- Personal and Family Financial Planning offered by University of FLORIDA (Coursera)

- Financial Planning for Young Adults offered by ILLINOIS (Coursera)

- Personal Finance Professional Certificate Course by Indiana University (edX)

- Managing My Money by The Open University – (FutureLearn)

- Personal Finance course by Khan Academy

11 Best Personal Finance Classes Online

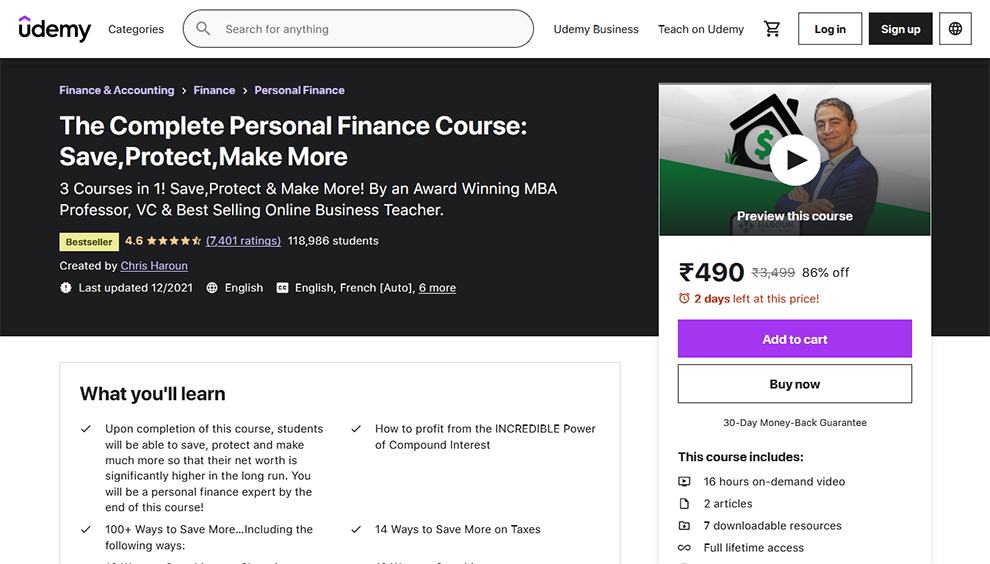

1. The Complete Personal Finance Course: Save, Protect, Make More (Udemy)

This personal financial planning course consists of personal finance tutorials that will cover:

- How to assess and dramatically reduce your personal spending so that your net worth grows significantly over time

- More than a hundred ideas to help you save a lot more money

- How simple improvements in saving habits may lead to riches later in life!

| Rating | 4.6 based on 7,363 ratings |

| Duration | 16 hours personal finance training |

| Level | Beginner level personal finance course online |

| Refund Policy | 30-day return policy |

| Certificate Provided | Yes |

| Course Material Provided | Yes |

| Live Classes/Recorded Lessons | Recorded personal finance classes online |

| Course Type | Paid |

| Course Instructor | Chris Haroun |

| Scope for Improvement (Cons) | The concepts are not explained in detail. However, this course can give you an overview of all things you can do for healthy personal finance. |

Topics Covered

- Ways to save money

- Power of compound interest

- Understanding the value of personal income statement

- Time value of money

- Preparing your current income statement

- How to save on taxes on cars & transportation, childcare, computers, debt repayments, education, entertainment, etc.

- Changing your perception of money

- Creating and understanding your balance sheet

- Tax strategies to protect your money

- Understanding your net worth and saving moving

- Protecting the money by having an organized filing system

- Creating a budget and picking the right bank

Learning Outcomes

- What are bonds and how can governments stimulate the economy?

- Understand real bonds – no theory required! (Examples of real corporate finance and international government bond investments)

- Bond investing: a step-by-step guide

- Bond investments should be added to your portfolio.

- Including commodity investments in your portfolio

- What is your most important personal investment and how much should you spend on a house?

- How do calculate mortgages payments? (Fixed rates versus interest only rates & more)

- What you should know if you’re considering investing in real estate

- How much should you spend on a rental property?

- Real estate investment trusts: An overview

- Including real estate investment trusts in your portfolio

- Investment types to avoid due to liquidity risks

Prerequisites

Excel 2013 (or a later version) is recommended to complete the course exercises that come with this personal finance training. The Excel exercises in this course are compatible with both the Windows and Mac versions of Excel.

Are these personal finance classes online meant for you?

This course is for anyone who wants to understand EVERYTHING there is to know about managing personal finances, including saving more and multiplying your money.

Review Alexandra C.

Excellent course. Taught me so much that I never learned in school. I definitely feel more empowered about my finances. Thanks Chris!

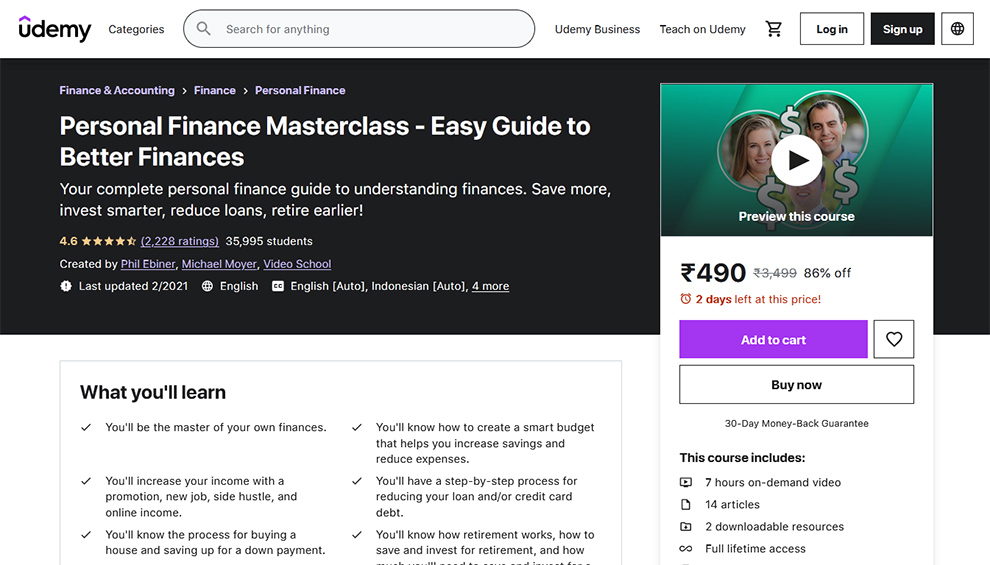

2. Personal Finance Masterclass – Easy Guide to Better Finances (Udemy)

Regardless of your degree of financial skill or the amount of money in your bank account, these comprehensive best personal finance classes are designed to offer you everything you need to take your finances to the next level.

Whether you’re in debt and don’t know what to do next, or you’re just curious about where to spend your money, you’ll learn the next steps to success.

You’ll be in a better position for financial independence if you actually grasp how things like credit, compound interest, taxes, and investment accounts operate. With this personal finance course online you’ll understand how to save more, spend less, and invest wisely.

| Rating | 4.6 based on 2217 ratings |

| Duration | 7 hours personal finance certification course |

| Level | Beginner level course |

| Refund Policy | 30-day return policy |

| Certificate Provided | Yes |

| Course Material Provided | Yes |

| Live Classes/Recorded Lessons | Recorded lessons |

| Course Type | Paid personal finance training |

| Course Instructor | Phil Ebiner, Michael Moyer and Video School |

| Scope for Improvement (Cons) | The content of these personal finance classes online needs to be updated. |

Topics Covered

- Golden rule of personal finance

- Why do the rich get richer

- How to retire early

- Measuring your financial success: net worth and cash flow

- Working power of money

- Setting up a budget

- Tools to help you track your spending

- Budgeting with Microsoft excel

- Way to reduce expenses

- 3 biggest budget busters

- Emergency fund

- Choosing a bank v/s credit union

- Automating finances

- Growing your income

- Importance of side income

- Turning hobbies into profit

- Making money online

- Credit cards

- Difference between credit and debit cards

- Loans, debts, and debts reduction

- How investing works

- Getting the best retirement plans

- Early retirement plan and financial freedom

- Saving taxes

Learning Outcomes

- Be in charge of your own funds.

- Understand how to construct a sensible budget that allows you to grow savings while decreasing costs.

- With a promotion, a new job, a side hustle, and internet revenue, you’ll be able to supplement your income.

- You’ll be given a step-by-step plan for paying off your loan and/or credit card debt.

- Understand the home-buying process and how to save for a down payment.

- Understand how retirement works, how to save and invest for retirement, and how much money you will need to save and invest for a worry-free future.

- Discover how to retire early and attain financial independence!

Prerequisites

- Students should be willing to have their assumed financial notions questioned.

- Students should be aware of how much debt they have, whether it is credit card debt, student loan debt, mortgage debt, vehicle loans, or any other type of personal debt.

Is this personal finance training meant for you?

This is the best course for:

- Those who wish to improve their financial situation and require assistance with their finances to increase their earnings.

- Who wants to learn how to invest wisely and cut costs to save more money.

- One who is in a credit card or loan debt.

- People who wish to purchase a home and save for a down payment.

Review Yerula C.

Loved this course! It sure is a great start on reaching my goal to improve my personal finances and smart investing for retirement. Lots of valuable resources and the instructors are very knowledgeable.

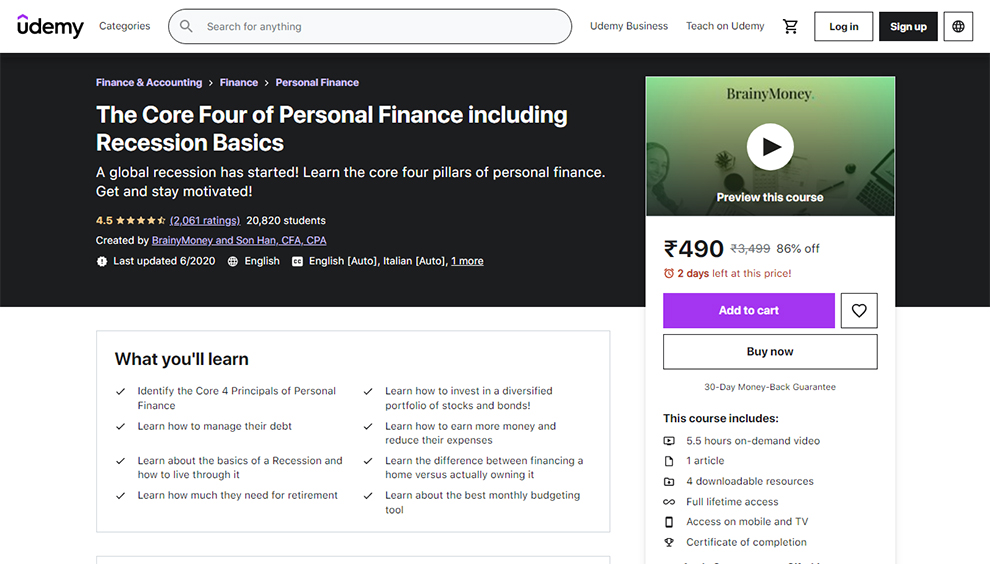

3. The Core Four of Personal Finance including Recession Basics (Udemy)

This is one of the best personal finance course online to teach you the four fundamental principles of personal finance. You will go through the four main foundations of personal finance in-depth in this personal finance certification course.

By the conclusion of this course, you will understand how to manage your funds and stay motivated. Later on, if you want to become a personal finance expert and retire early, for example, you will have a solid basis to understand how to do it.

You’ll also comprehend the benefits and drawbacks of various personal financial approaches.

| Rating | 4.5 based on 2060 ratings |

| Duration | 5.5 hours personal finance classes online |

| Level | Beginner level course |

| Refund Policy | 30-day return policy |

| Certificate Provided | Yes |

| Course Material Provided | Yes |

| Live Classes/Recorded Lessons | Recorded lessons |

| Course Type | Paid course with personal finance tutorials |

| Course Instructor | BrainyMoney and Son Han |

| Scope for Improvement (Cons) | This personal finance course online is a bit too specific with the USA world, where it’s normal to contract debts for school, cars and healthcare. That’s not so common in Europe and other parts of the world. |

Topics Covered

- Why personal finance matters

- About the instructor

- Live below your means

- Building a capital base and at-will employment

- What does being rich mean

- High net worth

- Net worth is the most important number

- Focus on your net worth

- Building a capital base

- Negative net worth

- Green and lose your job

- At-Will Employment

- Calculating net worth and budget

- Earn more than you spend

- Cut your spending by practicing essentialism

- More about stock market

- Index and index funds

- How much to invest

Learning Outcomes

- Determine the Core 4 Personal Finance Principles

- Discover how to build a diverse portfolio of stocks and bonds!

- Discover ways to handle their debt.

- Learn how to earn more money and save money.

- Learn the fundamentals of a recession and how to deal with it.

- Discover the distinction between financing a home and really buying one.

- Determine how much they require for retirement.

- Discover the finest monthly budgeting tool.

There are no prerequisites for these personal finance classes online.

Is this personal finance certification meant for you?

This is the best personal financial planning course for students seeking a solid foundation in Personal Finance

Review Tiffany B.

I LOVED this training. Trainer was engaging, super informative, and all this informtion will at some point be applied to everyday life.

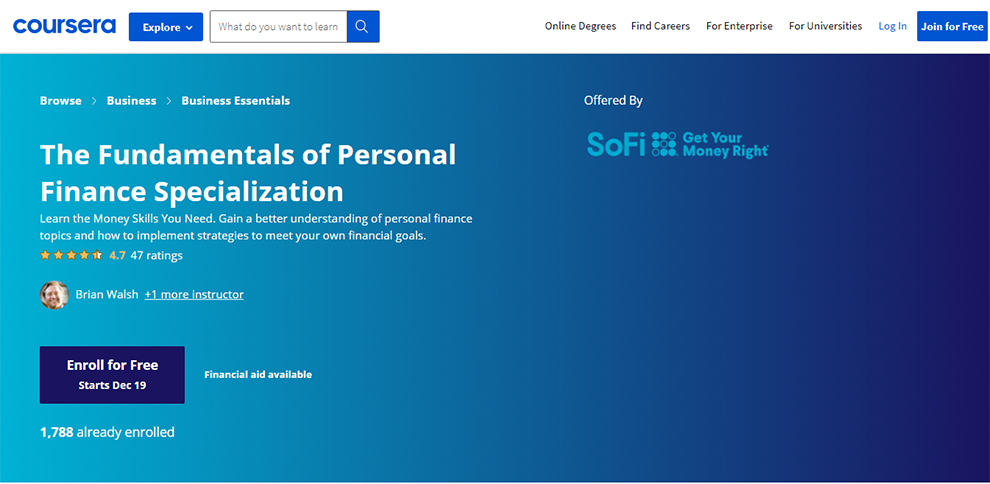

4. The Fundamentals of Personal Finance Specialization offered by SoFi (Coursera)

These best personal finance classes are designed for anybody who wants to take charge of their finance. These five courses will cover a wide range of personal finance subjects, such as budgeting, investing, and risk management.

The books, films, and exercises that come with this personal finance course online will equip you to comprehend your present financial situation and to take action to achieve your financial objectives. This personal finance training is intended for students in the United States of America.

| Rating | 4.7 based on 44 ratings |

| Duration | 7 hours |

| Level | Introductory level course |

| Refund Policy | 7-day free trial. No refunds after that. |

| Certificate Provided | Yes |

| Course Material Provided | Yes |

| Live Classes/Recorded Lessons | Recorded personal finance tutorials |

| Course Type | Paid |

| Course Instructor | Brian Walsh, Lauren Anastasio |

| Scope for Improvement (Cons) | Many points discussed are associated with the U.S laws and regulations which make it less relevant, if not irrelevant, for individuals following this course and not from the U.S. |

Topics Covered

- Introduction to Personal Finance

- Understanding net worth and credit score

- Assessing cash flow and taxes

- Planning and budgeting for future

- Building financial foundation

- Funding financial freedom

- Home Buying basics

- Saving money for the future

- Managing Debt

- Student loans

- Managing credit cards

- Types of Credit cards

- Working of credit cards

- Paying Down Debt

- The Snowball Method

- The Avalanche Method

- The Fireball Method

- Fundamentals of investing

- Investing Basics

- Bonds

- Mutual funds

- Risk Management in Personal Finance

Even though it is not a credit repair course, it will help you understand your net worth and credit score.

Learning Outcomes

- Financial planning

- Budgeting

- Investing

- Tax saving plans

- Knowledge of credit cards

- What is a credit score

- Retirement savings

- Retirement planning

- Saving funds

- Diversification of funds

- Active and passive investing

- Risk aversion

Are there any prerequisites for these personal finance tutorials?

The personal finance classes online are intended for high school and above students. Those without a high school diploma and those with advanced degrees will profit from the subject addressed. The concepts covered in the five personal finance certification courses are generally not taught in schools and can benefit anyone.

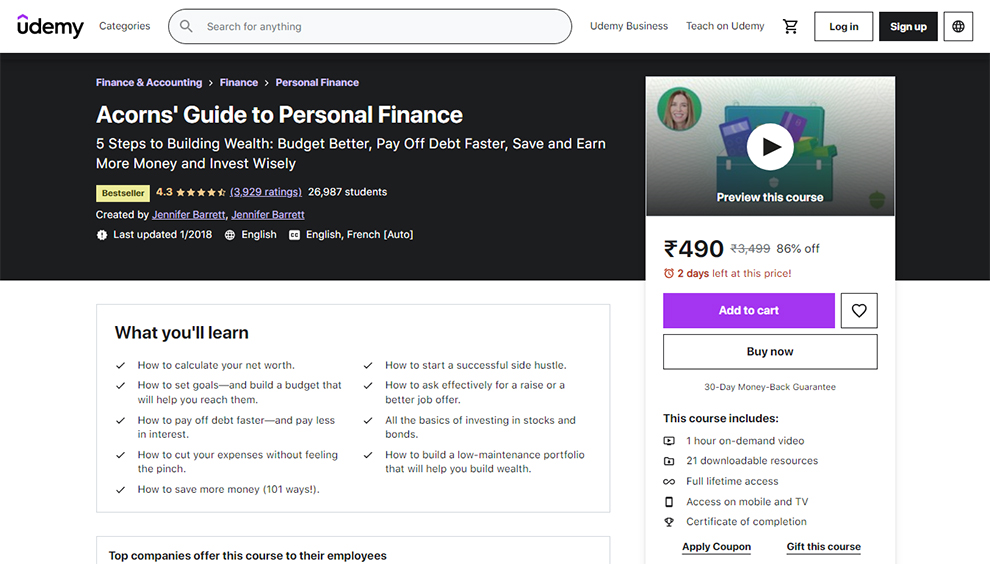

5. Acorns’ Guide to Personal Finance (Udemy)

This fundamental personal finance course online explains the what, when, how, and why of personal finance to assist you in the beginning to build wealth—regardless of how much money or financial expertise you have to begin.

You’ll learn the fundamentals of personal finance with this personal financial planning course as well as easy, on-the-go tactics and tools to manage your money. By the end of this personal finance training, you’ll know where you stand financially, where you want to go, and how you’re going to get there.

| Rating | 4.3 based on 3920 ratings |

| Duration | 1 hour |

| Level | Basic personal finance course |

| Refund Policy | 30-day return policy |

| Certificate Provided | Yes |

| Course Material Provided | Yes |

| Live Classes/Recorded Lessons | Recorded lessons |

| Course Type | Paid best personal finance classes |

| Course Instructor | Jennifer Barrett |

| Scope for Improvement (Cons) | There was practically no sound for section 2 in this course. |

Topics Covered

- How to pay debt faster

- Investing vigilantly

- Net Worth

- Budget

- Ways to lower your interest rate

- Ways to improve credit score

- Cutting the expenses

- Simple spending hacks

- Negotiating a better job

- Reasons to invest

- Where to invest

What will you learn from this personal finance course online?

- How to Determine Your Net Worth

- How to Get Started with a Successful Side Hustle

- How to set objectives and create a budget to help you achieve them.

- How to ask for a raise or a better job offer in an efficient manner.

- How to pay off debt quicker while paying less interest.

- All the fundamentals of stock and bond investment.

- How to reduce your spending without feeling the pinch.

- How to create a low-maintenance portfolio to help you accumulate money.

- How to Increase Your Savings

Prerequisites

There is no need for prior knowledge or tools for this personal finance training. All you need is a desire to see your hard-earned money increase through these personal finance classes online.

You’ll need some financial information on hand for the exercises, such as your take-home wage and the amount of debt you owe.

Is it the right personal financial planning course for you?

This is the best personal finance course online course for anyone who wants to master the fundamentals of personal finance, pay off debt more quickly, and begin generating money.

Review Stacey A.

This course has been very useful with great tips about building wealth and reading material to improve the management of our money.

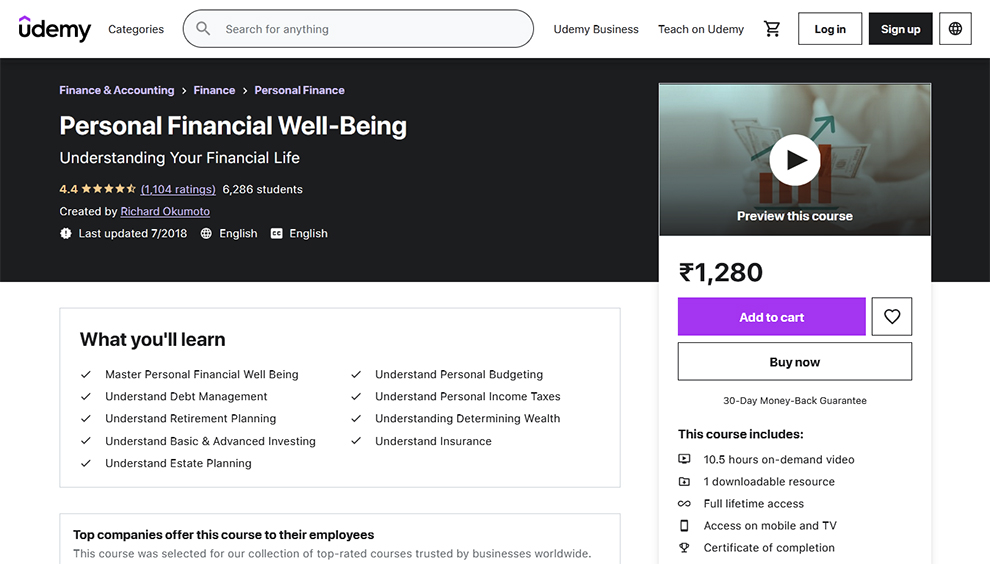

6. Personal Financial Well Being (Udemy)

This course is designed for Dot University in order to close the Wealth GAP and simplify personal money management.

The Personal Finance certification course employs two key strategies that reduce time-to-knowledge. Beginning with a landscape perspective and then presenting main building components gives an expedited approach to connecting the dots on how money works:

| Rating | 4.4 based on 1098 ratings |

| Duration | 10.5 hours personal finance course online |

| Level | Intermediate level course |

| Refund Policy | 30-day return policy |

| Certificate Provided | Yes |

| Course Material Provided | Yes |

| Live Classes/Recorded Lessons | Recorded lessons |

| Course Type | Paid course |

| Course Instructor | Richard Okumoto |

| Scope for Improvement (Cons) | More visual aids will make this personal financial planning course more interesting and engaging. |

Topics Covered

- Generating positive cash flow

- Collecting historical data

- Forecasting income and expenses

- Managing budget

- Debt Management

- Nature of debt

- Cost of debt

- Ability to acquire debt

- Personal income tax

- Introduction to retirement planning

- More about wealth and assets

- Asset appreciation

- Basic investing

- Stock investment

- Bond investment

- Mutual fund investment

- Higher risk investing

- Real estate investing

- Deferred savings

- Dealing with risk

- Various insurance

- Conclusion

Learning Outcomes

- Master Personal Financial Well-Being

- Understand Personal Budgeting

- Understand Debt Management Understand Personal Income Taxes

- Understand Retirement Planning

- Comprehension of Basic and Advanced Investing

- Discover Insurance

- Understand Estate Planning

Prerequisites

To take up these personal finance classes online, you need to have:

- A desire to obtain personal financial well-being

- Basic arithmetic abilities are required, as are Excel spreadsheet skills.

Should you go for this personal finance certification course?

This is the best personal finance course online for:

- Anyone who wants to regain control of their finances.

- Anyone who wishes to amass a fortune.

- Anyone who wants to safeguard what is valuable in life.

Review Tologon K.

As a beginner it was really useful to understand starting from basics to advanced topics.

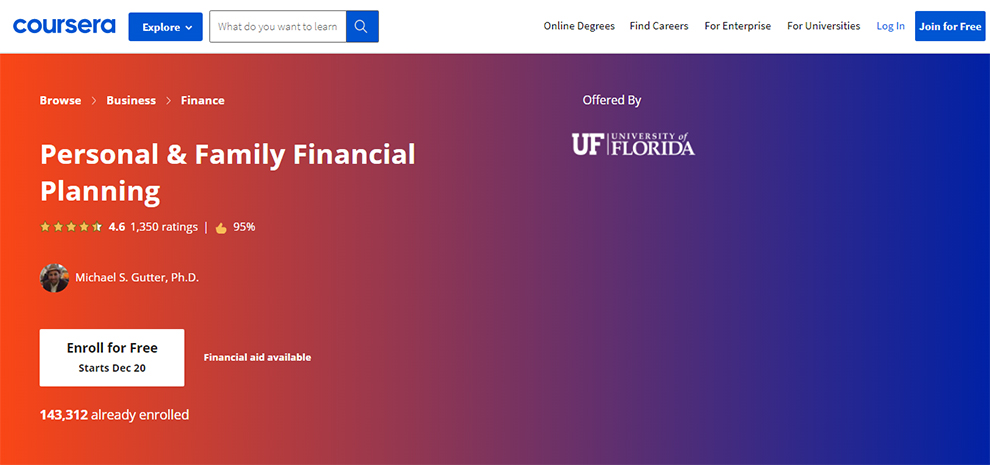

7. Personal and Family Financial Planning offered by University of FLORIDA (Coursera)

This personal financial planning course will cover a wide range of key personal financial management subjects in order to help you develop sound financial habits both at school and throughout your life.

| Rating | 4.6 based on 1347 ratings |

| Duration | 10.5 hours course |

| Level | Intermediate level course |

| Refund Policy | 14-day return policy |

| Certificate Provided | Yes |

| Course Material Provided | Yes |

| Live Classes/Recorded Lessons | Recorded lessons |

| Course Type | Paid personal finance certification course |

| Course Instructor | Richard Okumoto |

| Scope for Improvement (Cons) | More visual aids will make this course more interesting and engaging. |

What are the topics covered in this personal finance course online?

- Understanding personal finance

- Financial security

- Time value of money

- Financial statements, tools, and budgets

- Analyzing financial statements

- Managing income taxes

- Building and maintaining good credit scores

- Managing Risk

- Investment fundamentals

- Investing through mutual funds

- A personal plan of action

- Conclusion

Learning Outcomes

- Personal finance

- Insurance

- Bond investments

- Financial security

- Reviewing and analyzing statements

Prerequisites

None

Review AA.

The course was very accessible and very at ease when it came to completing the various assignments for evaluation. Was very satisfied with the video presentations and the various tutorials as well.

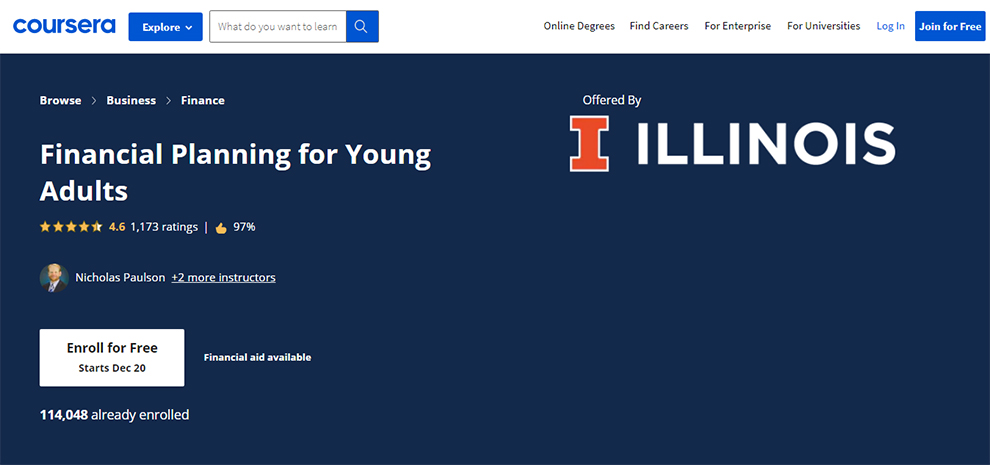

8. Financial Planning for Young Adults offered by ILLINOIS (Coursera)

Within each module, students will watch a mix of traditional lecture-style films and video vignettes that introduce financial concepts for debate among participants with this personal finance course online.

The video vignettes provide a new and intriguing dimension to this training. Each vignette depicts a real-life scenario in which financial judgments are to be taken with financial planning ideas.

After completing this personal finance certification course, learners will be asked to think critically about each scenario and consider how they would resolve it if faced with a similar circumstance in the future.

| Rating | 4.6 based on 1171 ratings |

| Duration | 20 hours course |

| Level | Intermediate level personal finance classes online |

| Refund Policy | 14-day return policy |

| Certificate Provided | Yes |

| Course Material Provided | Yes |

| Live Classes/Recorded Lessons | Recorded lessons |

| Course Type | Paid |

| Course Instructor | Nicholas Paulson, Charles R Chaffin, Kathryn L. Sweedler |

| Scope for Improvement (Cons) | This personal financial planning course is not meant for new learners and the pace is fast. |

Topics Covered

- Orientation

- Budgeting and cash flow management

- Pros and cons of using a credit card

- Saving strategies

- Building a saving habit

- Barriers to saving

- Time value of money

- Borrowing and Credit: Pros and Cons

- Investing tips

- Diversifying investments

- Risk management

- Financial planning as a career

Learning Outcomes

- Risk management

- Budgeting

- Saving

- Investment

Prerequisites

None

Review SV.

Amazing course highly recommended for all students, youth, teens so they have the knowledge prior before getting to the stage where they actually need to execute these things and save

9. Personal Finance Professional Certificate Course by Indiana University (edX)

This personal finance course online will provide you with the fundamental building blocks to lay a solid foundation for your future. The curriculum is designed for beginners to intermediate learners and consists of three personal financial planning courses.

- Personal Financial Planning Overview

- Personal Cash Management and Credit Planning for Risk, Retirement, and Investment

| Duration | 3 months course |

| Level | Intermediate level course |

| Refund Policy | 14-day return policy |

| Certificate Provided | Yes |

| Course Material Provided | Yes |

| Live Classes/Recorded Lessons | Recorded lessons |

| Course Type | Professional Certificate |

| Course Provider | Indiana University |

| Scope for Improvement (Cons) | Quite an expensive course with personal finance tutorials. |

Topics Covered

- Introduction to Personal Financial Planning

- Managing personal cash and credit

- Planning for risk and retirement

Learning Outcomes

With these personal finance classes online, you’ll learn to:

- Create a budget with financial integrity by reconciling your expenses and income, using tax methods, and developing a mentality for long-term financial success.

- Establish a stress-free financial life, investigate your financial alternatives thoroughly aware of the benefits and drawbacks.

- Recognize the importance and hazards of obtaining open and secured consumer credit.

- Determine your insurance requirements, seek solutions, and comprehend the influence of life stages on risk management decisions.

- Plan for retirement by determining your income requirements based on your present lifestyle; learn about the most typical sources of retirement income.

- Develop your investment attitude, which is critical to reaching your financial objectives, and understand how it affects your interactions with financial service providers.

10. Managing My Money by The Open University (FutureLearn)

With this personal finance certification course, learn how to handle personal finances, such as budgets, loans, investments, home purchases, pensions, and insurance.

This personal financial planning course begins with practical advice on creating a budget and utilizing it to make wise spending decisions.

You will learn about debts and investments, as well as how mortgages are used to fund house ownership. The crucial subject of pension planning is highlighted, along with product recommendations.

| Duration | 8 weeks |

| Level | Basic personal finance course |

| Certificate Provided | Yes |

| Course Material Provided | Yes |

| Live Classes/Recorded Lessons | Recorded lessons |

| Course Type | Paid personal finance course online |

| Course Provider | The Open University |

Topics Covered

- Financial planning and the life course

- Income, taxation, and benefits

- Expenditure and budgeting

- Debt and borrowing

- Savings and investments

- Housing and household Balance sheet

- Pensions

- Insurance

Learning Outcomes

- Report learning how to do financial planning, such as creating a budget and a home balance sheet.

- Compare and comprehend the costs of loans, mortgages, and other financial products.

- Describe the main types of personal investments, their features, and their returns to investors.

- Describe pension products and how to arrange for retirement.

- Summarize insurance goods and their pricing.

Is it the best personal finance course online for you?

This personal financial planning course is designed for those who want to improve their personal financial abilities to make better judgments while managing their finances and purchasing financial goods.

11. Personal Finance course by Khan Academy

Khan Academy offers one of the best personal finance classes online. The following topics are covered under the course offered by this platform.

Topics Covered

- Saving and budgeting

- Interest and debt

- Investments and retirement

- Income and benefits

- Housing

- Car expenses

- Taxes

- Paying for college

- Keep your information safe.

Sign Up Here

So, these were the top 11 basic personal finance courses as well as advanced ones. For professional needs you can also check our recommendation for QuickBooks training courses. Enroll in any course to upskill yourself now!