What is Corporate finance? Corporate finance is the domain of finance that deals with how corporations manage financing sources, capital structuring, accounting, and investment choices.

Corporate finance is usually concerned with enhancing shareholder value through long- and short-term financial formulation and execution of various methods. Thus, corporate financial operations vary from capital investment to tax planning.

Few critical points you should be aware of before enrolling in any online corporate finance courses:

- The most important point to mention here is how corporate finance is nothing but broadly a field of study to know how firms raise capital to fund themselves to maximize revenues and minimize costs.

- It is also concerned with the day-to-day operations of a company’s cash flows and long-term financial plans.

- Apart from studying capital structure, the subject also covers accounting, risk management, financial statement preparation, taxation, and investment decisions.

In This Article

- 14 Best Corporate Finance Courses Online

- Introduction to Corporate Finance – (Coursera)

- CFA Level 1 (2021/2022) – Complete Corporate Finance – (Udemy)

- Introduction to Finance and Accounting Specialization – (Coursera)

- MBA ASAP Corporate Finance Fundamentals – (Udemy)

- Essentials of Corporate Finance Specialization – (Coursera)

- Columbia’s Corporate Finance – (edX)

- Corporate Finance Essentials offered by IESE Business School – (Coursera)

- edX Corporate Finance and Valuation Methods of Professional Certificate Examination – (edX)

- Corporate Finance I: Measuring and Promoting Value Creation by ILLINOIS – (Coursera)

- Corporate Finance Il: Financing Investments and Managing Risk by ILLINOIS – (Coursera)

- LinkedIn Learning Corporate Finance

- Introduction to Corporate Finance – (CFI®)

- Corporate Finance – (Harvard Extension)

- The Chief Financial Officer Programme by London Business School – (Eruditus Executive Education)

- Conclusion

This Year’s 14 Best Corporate Finance Courses

1. Introduction to Corporate Finance by University of Pennsylvania – (Coursera)

It is one of the best corporate finance courses online. This course gives a quick introduction to the foundations of finance, emphasizing their application to a wide range of real-world scenarios, including personal finance, business decision-making, and financial intermediation.

| Rating | 4.6 based on 5060+ ratings |

| Duration | Approximately 7 hours |

| Level | Beginners corporate finance class online |

| Refund Policy | 30-day return policy |

| Certificate Provided | Yes |

| Course Material Provided | Yes |

| Live Classes/Recorded Lessons | Recorded lessons in corporate finance training |

| Course Type | Paid corporate finance class online with the option to avail of financial aid. |

| Course Instructor | Michael R Roberts |

| Scope for Improvement (Cons) | Many wrong answers are mentioned for the quiz which should be corrected |

Topics Covered under the corporate finance certificate online course

- Time Value of Money

- Interest Rates

- Discounted Cash flow analysis

- Return on investment

- Risk-return tradeoff

- Cost of capital

- Retirement savings

- Mortgage Financing

- Auto leasing

- Capital budgeting

- Asset valuation

- Discounted cash flow (DCF) analysis

- Net present value

- Internal rate of return

- Hurdle rate

- Payback period

Learning Outcome under Corporate Finance Courses

- Intuition and discounting

- Compounding

- Useful Shortcuts

- Taxes

- Inflation

- APR and EAR

- Term Structure

- Discounted Cash Flow: Decision Making

- Free Cash Flow

- Forecast Drivers

- Forecasting Free Cash Flow

- Decision Criteria

- Sensitivity Analysis

- Return on Investment

Prerequisites

Just the basic concepts of financing.

Is it the right course for you?

This corporate finance certificate online is designed for anybody who wishes to lay the groundwork for fundamental business skills in finance and accounting.

2. CFA Level 1 (2021/2022) – Complete Corporate Finance – (Udemy)

Here you have a full set of ten online corporate finance courses that cover all ten subjects of the CFA® curriculum. These courses are not superficial summaries but rather a comprehensive and concise presentation of the curriculum for each topic area.

The lessons are brief to help you use the Pareto Principle. We think that if you put in the ideal 20% work and use the appropriate method, you may potentially get 80% of the outcomes! Next, let us have a look at the highlights of this one of the best corporate finance courses online.

| Rating | 4.6 based on 1080+ ratings |

| Duration | 4 hours |

| Level | Complete corporate finance training for CFA aspirants |

| Refund Policy | 30-day money-back guarantee |

| Certificate Provided | Yes |

| Course Material Provided | Yes |

| Live Classes/Recorded Lessons | Recorded lessons |

| Course Type | Paid corporate finance certificate online course |

| Course Instructor | PrepNuggets by Keith Tan – CFA |

| Scope for Improvement (Cons) | There should be more exposure to the learners by giving ample questions in the quiz for practice. |

Topics Covered

- Introduction

- Corporate Governance and ESG

- Sources of Capital

- Capital Budgeting

- Uses of Capital

- Cost of Capital

- Capital Structure

- Measures of Leverage

- Working Capital Management

- Bonus: Further Resources for your exam preparation

After completing this corporate finance training, you’ll be familiar with:

- The principal-agent and other corporate governance relationships.

- Stakeholder management and the techniques for managing stakeholder relationships and mitigating risks.

- The roles and responsibilities of a company’s board of directors and committees.

- Computing a capital project’s npv, irr, payback duration, and profitability index.

- Analyze and choose capital projects using npv and irr principles.

- Computing a firm’s weighted average cost of capital.

- Determining a firm’s cost of debt, cost of preferred stock, and cost of equity.

- Calculating and comprehending a firm’s operating leverage, financial leverage, and overall leverage.

- How to calculate and evaluate the available breakeven quantity of sales.

Prerequisites for these online corporate finance courses

- Understanding of fundamental maths

- Understanding the Concepts of Time Value of Money

Is it the right course for you?

- This corporate finance class online is designed for CFA Level 1 candidates.

- In addition, this corporate finance certificate online course is designed for those who are interested in the CFA Program.

3. Introduction to Finance and Accounting Specialization – (Coursera)

This Specialization introduces corporate finance and accounting, emphasizing their application to a wide range of real-world situations such as personal finance, financial decisions, financial intermediation, and how accounting principles and managerial incentives influence the economic reporting process.

This corporate finance training includes homework, quizzes, and an additional Excel spreadsheet to help learners obtain a complete knowledge of key topics in corporate finance and accounting.

The corporate finance certificate online course covers bookkeeping principles, accrual accounting, cash flow analysis, and more!

These corporate finance courses give a solid foundation in the subject by including topics such as financial models, valuing claims, and making financing decisions.

| Rating | 4.4 based on 926+ ratings |

| Duration | Approximately 5 months |

| Level | Beginners |

| Refund Policy | 30-day money-back guarantee |

| Certificate Provided | Yes |

| Course Material Provided | Yes |

| Live Classes/Recorded Lessons | Recorded lessons in corporate finance training |

| Course Type | Paid corporate finance certificate online |

| Course Instructor | Jessica Wachter, Brian J Bushee, Michael R Roberts |

| Scope for Improvement (Cons) | Lengthy course which makes learning monotonous. |

Topics Covered

This specialization is further divided into four online corporate finance courses

- Fundamentals of Finance

- Introduction to Corporate Finance

- Introduction to Financial Accounting

- More Introduction to Financial Accounting

Learning outcome of corporate finance class online

- You will learn to make better financial judgments, random cash flow streams are discounted and compounded.

- Understand the difference between net present value and internal rate of return (IRR)

- Learn to Classify Cash flow into operational, investing, and financing operations

- Know how do businesses account for their investments in debt and equity securities?

Prerequisites

Knowledge of fundamental high school Math.

Is it the right corporate finance certificate online course for you?

It is a good course for:

- Anyone interested in learning the foundations of business finance.

- Anyone who wants to examine financial statements and disclosures and learn how accounting rules and managerial incentives influence the financial reporting process.

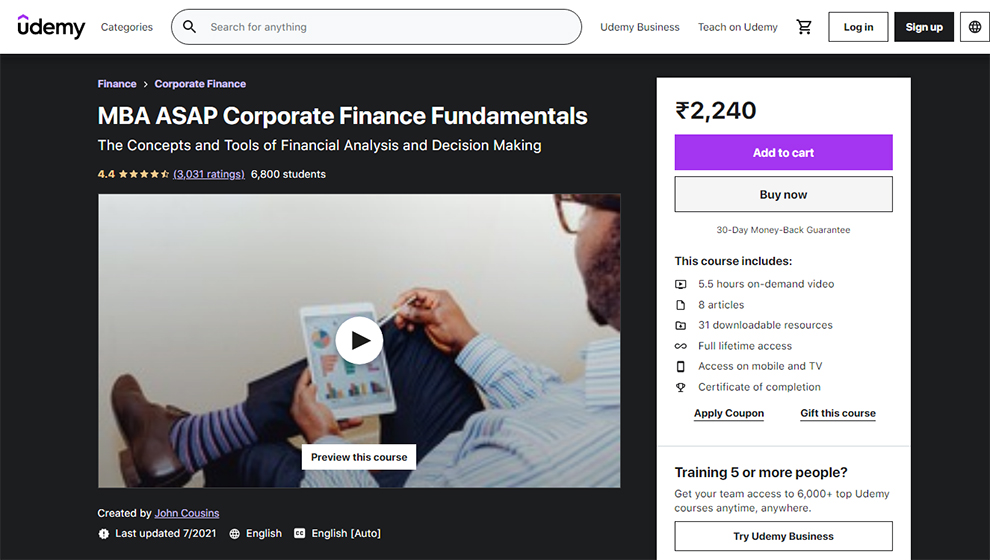

4. MBA ASAP Corporate Finance Fundamentals – (Udemy)

Corporate finance is a collection of abilities that connect with all areas of running a corporation. It is also instrumental in our daily lives when making judgments about purchasing or leasing, borrowing money, and making large purchases.

This course gives you the right corporate finance training with analytical skills for thinking about obtaining, spending, and conserving.

This course presents a foundation for how financial professionals decide how, when, and where to invest money. Also, it is considered a great pick amongst the best corporate finance courses online.

| Rating | 4.4 based on 3000+ ratings |

| Duration | 5.5 hours |

| Level | Beginners |

| Refund Policy | 30-day money-back guarantee |

| Certificate Provided | Yes |

| Course Material Provided | Yes |

| Live Classes/Recorded Lessons | Recorded lessons |

| Course Type | Paid course |

| Course Instructor | John Cousins |

| Scope for Improvement (Cons) | This course should involve real-life examples to make the topic more relatable and understandable. |

Topics Covered

- Introduction to Corporate Finance

- Financial Statements, their Interconnection and Flow

- Financial Statement Analysis

- The Time Value of Money

- Net Present Value

- Internal Rate of Return

- Finance Q & A

- Financial Projections

- Breakeven Analysis

- Budgets

- Technology Trends in Accounting and Corporate Finance

- Economics and Finance

- How to Create a Diversified Stock Portfolio

- Startup Finance

- Corporate Finance and Business Ethics

Learning Outcome

- This course presents a foundation for how financial professionals decide how, when, and where to invest money.

- You will utilize these tools and calculations to evaluate assets and make financial decisions about funding and allocating money and resources to the best initiatives.

Prerequisites

This corporate finance certificate online course does not have any prerequisites.

Is it the right course for you?

- This course is for anyone interested in acquiring a skill set that will make them more valuable at their job, help them start something on the side, or allow them to start their own business.

- If you are considering an MBA or are currently enrolled in a program and are planning to take accounting and finance classes, this course will equip you to thrive in your program.

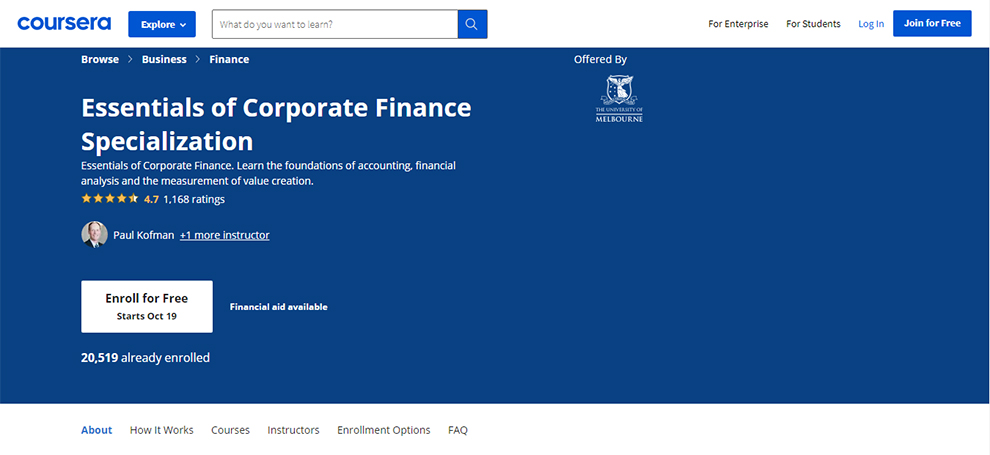

5. Essentials of Corporate Finance Specialization – (Coursera)

With this corporate finance training, you will develop a solid grasp of the subject. You will have sound knowledge of accounting concepts and financial analysis, how global markets produce value, the options businesses confront when making financial decisions, and defining attitudes toward risk.

The Specialization ends with a Capstone project that allows you to use the skills you’ve gained throughout the online corporate finance courses.

| Rating | 4.7 based on 1160+ ratings |

| Duration | 5 months |

| Level | Intermediate |

| Refund Policy | 30-day money-back guarantee |

| Certificate Provided | Yes |

| Course Material Provided | Yes |

| Live Classes/Recorded Lessons | Recorded corporate finance class online |

| Course Type | Paid course |

| Course Instructor | Paul Kofman, Sean Pinder (Offered by University of Melbourne) |

| Scope for Improvement (Cons) | More in-depth analysis should be incorporated to make this course more worthwhile. |

Topics covered

- The Language and Tools of Financial Analysis

- The Role of Global Capital Markets

- Corporate Financial Decision-Making for Value Creation

- Alternative Approaches to Valuation and Investment

- Essentials of Corporate Finance Capstone

The learning outcome of this online corporate finance courses

- Students will study the fundamentals of accounting concepts and financial analysis and the connections between them, and the assessment of value creation at the business level.

- Participants will discover how diverse marketplaces worldwide may interact to produce value for businesses and their stakeholders while successfully managing risk.

- Learners will understand the significant financial decisions that contemporary companies must make and the different approaches that may be used to maximize the value of the firm’s assets.

- Students will grasp the intuitive underpinnings of asset and investment valuation and how companies apply different valuation methodologies in practice.

Prerequisites

- A rudimentary understanding of statistics and the ability to solve simple algebraic problems.

- Knowledge of Microsoft Excel (or a functionally equivalent spreadsheet program). Participants should be able to summarize data using the graphical tools provided by the software.

Is it the right course to earn a corporate finance certificate online?

Anyone interested in learning the fundamentals of accounting, financial analysis, and value creation measurement can go for these online corporate finance courses.

Sign Up Here

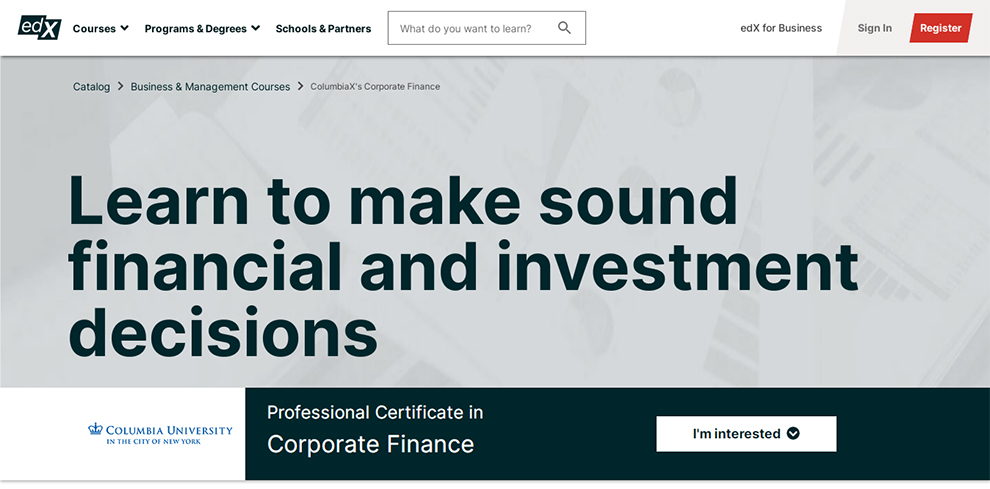

6. ColumbiaX’s Corporate Finance Professional certificate – (edX)

Under this course, the learners will study how to evaluate a company and make sound financial and investment decisions.

In addition, students will get the chance to study through a range of real-world transactions and case studies and work through activities in creating Excel models to enhance their subject knowledge.

| Duration | 3 months |

| Level | Intermediate |

| Refund Policy | 30-day money-back guarantee |

| Certificate Provided | Yes |

| Course Material Provided | Yes |

| Live Classes/Recorded Lessons | Recorded lessons |

| Course Type | Paid course |

| Course Instructor | Daniel Wolfenzon |

| Scope for Improvement (Cons) | It is an expensive pick as compared to other courses listed here. |

Topics Covered

- Introduction to best Corporate Finance courses online

- Free Cash Flow Analysis

- Risk & Return

- Valuation Framework (including, as special cases, valuation of stocks and bonds, and evaluation of investment opportunities)

- For company valuation, use the free cash flow technique.

- Risk and return concepts, as well as the determination of the opportunity cost of capital

- Alternative sources of external finance for corporate activities

Learning Outcome

- Understand both strong theoretical financial concepts and the actual context in which financial choices are made.

- How to use the free cash flow technique to evaluate a company.

- Use valuation and discounting frameworks.

- Stocks and bonds should be valued.

- Calculate the ROI of any project.

- Projecting cash flows and estimating residual value are used to evaluate a company.

- How to make corporate investment decisions.

- Understand the impact of a firm’s capital structure on the risk of its stock and debt.

- Assess risk and estimate an asset’s projected return depending on its risk.

Prerequisites

Basic knowledge of corporate finance must be there.

Is it the right course for you?

This course is designed for students who want to develop their careers in fields such as investment banking, private equity, consulting, general management, and CFO track roles inside a business.

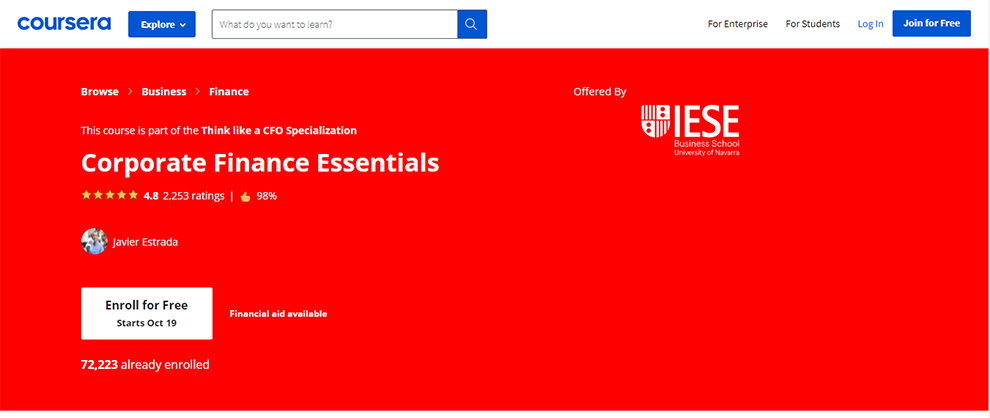

7. Corporate Finance Essentials offered by IESE Business School – (Coursera)

By the end of this one of the best corporate finance courses online, you will be able to comprehend essential financial issues concerning firms, investors, and their interactions in the capital markets.

You should also understand the majority of what you read in the financial news and utilize the basic financial terminology of businesses and finance experts by the end of this course.

| Rating | 4.8 based on 2250+ ratings |

| Duration | 13 hours |

| Level | Intermediate |

| Refund Policy | 30-day money-back guarantee |

| Certificate Provided | Yes |

| Course Material Provided | Yes |

| Live Classes/Recorded Lessons | Recorded lessons |

| Course Type | Paid course |

| Course Instructor | Javier Estrada |

| Scope for Improvement (Cons) | The pace of this course is very slow which makes the learner lose interest. |

Topics Covered

- Online Corporate Finance Courses Overview

- Risk and Return

- Correlation and Diversification

- The CAPM and the Cost of Capital

- Estimating the Cost of Capital – An application

- Project Evaluation

- Corporate Value Creation

- Final Quiz

Learning Outcome

- Corporate Finance

- Financial Risk

- Evaluation

- Investment

Prerequisites

Basic knowledge of finance.

Is it the right course for you?

Anybody interested in gaining a solid grasp of Accountability, Operational Finance, and Corporate Finance

8. Corporate Finance and Valuation Methods of Professional Certificate Examination – (edX)

If you have a thorough grasp of online corporate finance courses, you should take the New York Institute of Finance’s Corporate Finance and Valuation Methods Professional Certificate Examination.

The test consists of 26 multiple-choice questions and is timed for 60 minutes. To be eligible for the certificate, students must achieve a grade of 70% or above.

| Duration | 1 week |

| Level | Introductory |

| Refund Policy | 30-day money back guarantee |

| Certificate Provided | Yes |

| Course Material Provided | Yes |

| Live Classes/Recorded Lessons | Recorded lessons |

| Course Type | Paid course |

| Course Instructor | Douglas Carroll |

| Scope for Improvement (Cons) | Pricier than other courses. |

Learning Outcomes

The students will get a Verified Certificate from NYIF for all aspects of the Corporate Finance and Valuation Methods curriculum.

Prerequisites

- Financial Mathematics and Capital Budgeting Fundamentals

- Cost of Capital, Discounted Cash Flow (DCF), and Other Methodologies of Valuation

- Capital Budgeting and Corporate Finance Applications of Option Pricing

- Alternatives for Corporate Funding and Financing Strategies

Is it the right course for you?

Anyone who wants to earn a professional certificate in Corporate Finance and Valuation Methods from the New York Institute of Finance.

9. Corporate Finance I: Measuring and Promoting Value Creation by ILLINOIS – (Coursera)

Next on our list of best corporate finance courses, is this course by the University of Illinois. This is part 1 of the 2-part course.

In this corporate finance class online, you will learn how to apply fundamental financial principles to understand and assess company success and discover and encourage genuine value creation.

You will learn how to use accounting data to calculate important financial ratios that may be used to assess a company’s financial health and manage its short- and long-term liquidity needs.

| Rating | 4.7 based on 1000+ ratings |

| Duration | 26 hours |

| Level | Intermediate |

| Certificate Provided | Yes |

| Course Material Provided | Yes |

| Live Classes/Recorded Lessons | Recorded lessons |

| Course Type | Paid course |

| Course Instructor | Heitor Almeida |

| Scope for Improvement (Cons) | The course content does not match the duration assigned for this course. The duration of completing the course should be increased. |

Topics Covered

- Course Overview

- The Objective of the Corporation and Analysis of Financial Ratios

- Financial Planning

- Making Investment Decisions

- Mergers and Acquisitions, Risk, and Performance Evaluation

- Course Conclusion

Learning Outcome

- Learn how businesses make investment decisions that add value to their shareholders.

- Use accounting statements to assess a company’s financial health

- Forecast and manage a company’s short- and long-term liquidity needs

- Assess the contribution of a new project or acquisition to shareholder value

- Incorporate risk into investment decisions using appropriate discount rates

- Evaluate the performance of a company or divisions of a company.

Prerequisites

Students must have basic knowledge of Corporate Finance.

Is it the right course for you?

This is the ideal course for anyone who is looking for specialization in Financial Management.

10. Corporate Finance Il: Financing Investments and Managing Risk by ILLINOIS – (Coursera)

This course will teach you how firms determine how much debt to take on and whether to raise financing from markets or banks. You will also learn how to assess and manage credit risk without a credit repair certification and how to deal with a financial crisis.

In addition, you will go through the mechanics of dividends and share repurchases, as well as how to pick the best strategy to distribute capital to investors.

| Rating | 4.8 based on 745+ ratings |

| Duration | 21 hours |

| Level | Intermediate |

| Certificate Provided | Yes |

| Course Material Provided | Yes |

| Live Classes/Recorded Lessons | Recorded lessons |

| Course Type | Paid course of corporate finance class online |

| Course Instructor | Heitor Almeida |

| Scope for Improvement (Cons) | The course runs too fast which makes it difficult for learners to get the examples well. |

Topics Covered

- Course Orientation

- Raising Financing: The Capital Structure Decision

- Understanding Debt Financing and Payout Policy

- Risk Management

- Financial Management of Acquisitions and R&D

- Course Conclusion

Learning Outcome

- Understand how organizations make value-creating financing, payout, and risk management decisions. Measure the implications of leverage on profitability, risk, and valuation.

- Manage credit risk and financial hardship with suitable financial instruments

- Recognize the linkages between payment policies and corporate success

- To counter financial risks, use derivatives and liquidity management. Choose a suitable finance package for a merger and acquisition or leveraged buyout transaction.

Prerequisites

Before pursuing this course, the learners must complete Corporate Finance I: Measuring and Promoting Value Creation by ILLINOIS (Coursera).

Is it the right course for you?

This is the perfect course for anybody seeking to specialize in Financial Management.

11. Corporate Finance – (LinkedIn Learning)

LinkedIn Learning is a skill-building platform that engages learners by offering customized experiences, an active community, and insights from across all channels.

LinkedIn Learning provides expert-led courses on Corporate Finance Training to help you stay ahead of the competition. The various online corporate finance courses offered are listed below-

- Corporate Finance Foundations

- Become a Financial Analyst

- Finance Foundations

- Corporate Financial Statement Analysis

- Corporate Finance: Robust Financial Modeling

- Accounting Foundations: Internal Controls

12. Introduction to Corporate Finance – (CFI®)

The corporate finance courses by CFI will provide an overview of all the important concepts required for a successful career in investment banking, equities research, private equity, corporate development, financial planning, and analysis (FP&A), treasury, and other areas.

| Rating | 4.5 |

| Duration | 2 hours and 30 minutes |

| Level | Beginner level |

| Certificate Provided | Yes |

| Course Material Provided | Yes |

| Live Classes/Recorded Lessons | Recorded lessons in corporate finance classes online |

| Course Type | Full access with subscription only |

| Course Provider | CFI |

| Scope for Improvement (Cons) | The course duration is quite short to sum up everything. |

Topics Covered under this corporate finance training

- Introduction

- Capital Investment

- Capital Financing

- Dividends and Return of Capital

- Conclusion

- Qualified Assessment

Learning Outcome

- Different capital market participants

- Lifecycles of funding

- Methods of valuing a business

- Processes of mergers and acquisitions (M&A)

- Raising of equity capital

- Debt capitalization

- Careers in corporate finance

Prerequisites

No requirement as it is an introductory course

Is it the right course for you?

This is one of the top-rated corporate finance courses ideal for anybody working in or aspiring to work in investment banking, equities research, private equity, corporate development, finance, or accounting.

This course is a fantastic primer for beginners as well as a terrific refresher for expert practitioners.

13. Corporate Finance – (Harvard Extension)

This course aims to improve analytical abilities for making financial decisions and risk assessments in business investment. In essence, the course investigates the corporate finance patterns that have formed the familiar yet complicated terrain of today’s global economy.

| Duration | 2 hours session every week |

| Level | Beginner level |

| Refund Policy | 30-day money-back guarantee |

| Certificate Provided | Yes |

| Course Material Provided | Yes |

| Live Classes/Recorded Lessons | Recorded lessons as well the option to attend live sessions of corporate finance class online |

| Course Type | Paid course |

| Course Instructor | Ned Gandevani, George Barsom |

Topics Covered

- Discounted cash flow and other valuation techniques

- Risk and return

- Capital asset pricing model

- Corporate capital structure and financial policy

- Capital budgeting

- Mergers and acquisitions

- Investment and financing decisions

Prerequisites

MGMT E-1000, MGMT E-2000 by Harvard, or similar is useful before this corporate finance training.

14. The Chief Financial Officer Programme by London Business School – (Eruditus Executive Education)

The Chief Financial Officer (CFO) Program is intended to widen the students’ perspective and prepare them to be strategic CFOs in the future.

Topics Covered under Corporate Finance Courses

- Financial performance

- Corporate governance

- Taxation

- Corporate social responsibility

- Mutual funds.

Learning outcomes of corporate finance class online

- Create a long-term strategic vision that combines financial and non-financial performance goals with corporate strategy.

- Improve your capacity to anticipate, measure, and track financial and non-financial performance.

- Improve your technical knowledge and financial knowledge.

- Analyze the current trends and external influences influencing your organization to strengthen your position as a trusted internal adviser and important decision-maker.

- To maximize effect, create, lead, inspire, and sustain high-performing teams.

Prerequisites

Senior finance professionals who are new to the CFO job and are preparing for a CFO assignment or another position of strategic financial leadership.

Is it the right course for you?

- Senior-level executives with strategic and financial responsibility

- At least ten years of work experience

- From a variety of sectors, ranging from major corporations to start-ups

Related: Best Stock Market Courses, Econometrics Classes, QuickBooks Training

Conclusion

We have put down the list of these courses for beginners and intermediate learners. These courses are the best corporate finance courses that will help learners excel in their profession. For more information on any of the corporate finance classes online, visit the website annexed.